Summary

This QVI initial research report on Meta Platforms analyzes the company’s current wealth and the stock’s present value of the interactive social media player founded as Facebook.

With a wide moat value proposition, Meta Platforms, and its three billion Facebook, Instagram, Messenger, and WhatsApp users, is a captive advertising powerhouse.

The company’s returns on management and enterprise downside risks also reflect solid fundamentals.

However, the underperforming shareholder yields, premium valuation multiples, and share price average downside risks suggest a hold or watch.

When referencing this report, premium (paying) subscribers can access their Quality Value Investing (QVI) Glossary of Investing Terms and Metric Targets. Unless noted, all data presented is sourced from Seeking Alpha Premium as of the market close on September 19, 2023, and intended for illustration only.

The stock picks in the QVI Real-Time Portfolios have achieved alpha for 14 years by focusing research and analysis solely on a company’s current wealth and its share price’s present value. In other words, just the facts without unreliable predictive analysis typical of the buy-side or the business modeling overkill of Wall Street sell-side analysts.

In this initial QVI Research Report on Meta Platforms, Inc., we’ll take a look at this Wall Street and Main Street darling communications services stock to see if it meets Quality Value Investing’s active portfolio inclusion criteria based on our checklist analysis of the business’s current wealth and its share price’s present value.

Meta Platforms: Company Current Wealth

To uncover the current wealth of the company, QVI defines the value proposition, measures select returns on management, and assesses enterprise downside risks.

Value Proposition

QVI Research Report’s value proposition section provides a brief synopsis of the company’s business model, major-exchange listing, stock symbol, market capitalization, and dividend-paying status. In addition, it defines the competitive advantages of a company’s products or services to its customers compared to the industry, including the stock’s historical performance vs. the sector and market.

Meta Platforms, Inc. META 0.00%↑ is a non-dividend-paying large-cap stock in the communications services sector’s interactive media industry.

Meta Platforms, Inc. engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables worldwide. It operates in two segments, Family of Apps and Reality Labs.

The Family of Apps segment offers Facebook, which enables people to share, discuss, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, communities, and businesses across platforms and devices through text, audio, and video calls; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately.

The Reality Labs segment provides augmented and virtual reality-related products comprising consumer hardware, software, and content that help people feel connected, anytime, and anywhere.

The company was formerly known as Facebook, Inc. and changed its name to Meta Platforms, Inc. in October 2021. Meta Platforms was incorporated in 2004 and is headquartered in Menlo Park, California, USA.

QVI’s value proposition elevator pitch for Meta Platforms:

With as wide a moat as there is in social media, Meta Platforms, and its 3 billion Facebook, Instagram, Messenger, and WhatsApp users is a captive advertising powerhouse.

Performance vs. Sector and Market

The chart below illustrates META’s performance against the Communications Services Select Sector SPDR® Fund ETF (NYSE: XLC) since XLC’s inception on June 18, 2018, and the SPDR® S&P 500 ETF Trust (NYSE: SPY) for the same period. Notably, META’s share price kept pace with its sector and the market before falling off in the 2022 inflationary bear market and recovering in 2023.

Due Diligence Resources

For a more in-depth analysis of the all-important value proposition, visit Meta Platform’s investor relations webpage and its most recent Form 10-K Annual Report submitted to the US Securities and Exchange Commission or SEC.

QVI’s value proposition rating for Meta Platforms: Bullish.

META Total Return vs. XLC and SPY

Meta Platforms, Inc. (META) Total Return: +52.56%

Communications Services Sel Sec SPDR ETF (XLC) TR: +41.38%

SPDR S&P 500 ETF Trust (SPY) Total Return: +75.29%

Since June 18, 2018 (as of September 19, 2023)Earn premium subscription rewards when referring friends, family, or colleagues to QVI:

Returns on Management

QVI Research Report’s fundamentals section measures the performance strength of the company’s senior management by analyzing revenue growth, net profit margin, and returns on equity and invested capital.

Revenue Growth and Net Profit Margin

Per the chart below, Meta Platforms had a positive trailing three-year annualized low-double-digit revenue growth of +11.02%, outperforming the +3.72% median growth of the communications services sector. Meta Platforms’ topline has returned +0.93% growth in the last 12 months.

Farther down the income statement, Meta Platforms had a three-year, mid-double-digit net profit margin of +18.71%, trouncing the sector’s median net margin of +4.13%.

Returns on Equity and Invested Capital

Meta Platforms’s management produced a three-year return on equity, or ROE, of +17.77%, above QVI’s targeted threshold and well ahead of the sector’s median ROE of +4.12%.

Stock buyback programs often elevate ROE. For example, in February, Meta Platforms’s board of directors authorized $40 billion in additional share repurchases after executing $28 billion of buybacks in 2022. However, are they buying back shares at value prices on behalf of shareholders?

At 16.52%, Meta Platforms’s three-year return on invested capital, or ROIC, was above QVI’s threshold and significantly higher than the sector’s median ROIC of 3.49%, suggesting that its senior executives are outstanding capital allocators. In addition, Meta Platforms’s ROIC exceeded its weighted average cost of capital, or WACC, of 7.33%. (Source of WACC: GuruFocus).

Double-digit three-year revenue growth and sector-beating profit margins and returns on equity and invested capital suggest that Meta Platforms’ management continues its two decades of second-level performance in Silicon Valley.

QVI’s fundamentals rating for Meta Platforms: Bullish.

META Returns on Management

Meta Platforms, Inc. (META) Revenue Growth: +11.02%

Meta Platforms, Inc. (META) Profit Margin: +18.71%

Meta Platforms, Inc. (META) Return on Equity: +17.77%

Meta Platforms, Inc. (META) Return on Invested Capital: +16.52%

Three-Year Trailing (as of September 19, 2023)Enterprise Downside Risks

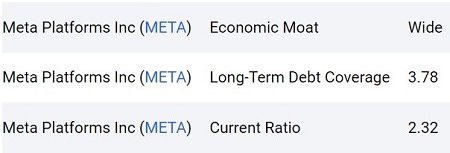

QVI Research Report’s enterprise downside risks section discovers and rates the targeted company’s safety margins of its business model by assessing the economic moat and debt leverage/coverage.

Economic Moat

Morningstar assigns META a wide moat rating.

We assign Meta a wide moat rating based on network effects around its massive user base and intangible assets consisting of a vast collection of data that users have shared on its various sites and apps. Given its ability to profitably monetize its network via advertising, we think Meta will more likely than not generate excess returns on capital over the next 20 years.

- Ali Mogharabi, Senior Equity Analyst, April 27, 2023

Long- and Short-Term Debt Coverages

As reported on its June 2023 quarterly financial statements, Meta Platforms’s long-term debt coverage was 3.78. Thus, in theory, the company could pay down 100% of its longer-term debt obligations more than three times in a crisis using its liquid assets, such as cash and equivalents, short-term investments, accounts receivable, prepaid expenses, and restricted cash.

In a further test of paydown capacity, Meta Platforms’s long-term debt to equity was 14.15%, well below QVI’s ceiling.

Meta Platforms’s short-term debt coverage, or current ratio, was 2.32 times, well above QVI’s floor. Thus, its balance sheet provides ample liquid assets necessary to pay 100% of its current liabilities more than twice, including accounts payable, accrued expenses, lease obligations, income taxes payable, and unearned revenue.

QVI’s enterprise downside risk rating for Meta Platforms: Low

Meta Platforms: Enterprise Downside Risks

META: Present Value and Investment Thesis

Next, QVI dives into the shareholder yields, valuation multiples, share price downside risks, and overall investment thesis of Meta Platforms, Inc. (META), including potential catalysts. So, let’s dig further after reading the required disclosures and background information.

Disclosure: I/we have no beneficial positions through the direct ownership of the common shares of any stocks mentioned. I wrote this report myself, and it expresses my own opinions. I am not receiving compensation for it other than from Substack paid subscriptions. I have no business relationship with any company whose stock is mentioned in this article.

Additional Disclosure: Quality Value Investing by David J. Waldron’s primary ticker research reports are for informational purposes only. The accuracy of the data cannot be guaranteed. Narrative and analytics are impersonal, i.e., not tailored to individual needs nor intended for portfolio construction beyond his family portfolio, which is presented solely for educational purposes. David is an individual investor and author, not an investment adviser. Readers should always engage in their own research or due diligence and consider (as appropriate) consulting a fee-only certified financial planner, licensed discount broker/dealer, flat fee registered investment adviser, certified public accountant, or specialized attorney before making any investment, income tax, or estate planning decisions.

About the Writer

David J. Waldron is the contributing editor of Quality Value Investing and author of the international-selling book Build Wealth with Common Stocks: Market-Beating Strategies for the Individual Investor. David’s mission is to inspire the achievement of his readers’ financial goals and dreams. His work has been featured on Seeking Alpha, TalkMarkets, ValueWalk, MSN Money, Yahoo Finance, QAV (Australia’s #1 Value Investing Podcast), Money Life with Chuck Jaffe, LifeBlood with George Grombacher, The Acquirer’s Multiple, Amazon, Barnes & Noble, Apple Books, the BookLife Prize, and Publisher’s Weekly. David received a Bachelor of Science in business studies as a Garden State Scholar at Stockton University and completed The Practice of Management Program at Brown University.

Bonus: Founding Subscribers of QVI on Substack are eligible to receive a personalized complimentary copy of the case laminate hardcover edition of the book from the author.

META: Stock Price Present Value

Keep reading with a 7-day free trial

Subscribe to Quality Value Investing to keep reading this post and get 7 days of free access to the full post archives.