The US Labor Market is Resilient, But is the Consumer Healthy? | Part 1

Guest post by Amrita Roy of The Pragmatic Optimist on Substack | Part 1 of 2

Note from David: I am excited to introduce Amrita Roy of The Pragmatic Optimist as a guest writer on Quality Value Investing. Releasing her newsletter in September, Amrita’s work has stormed Substack’s Finance category with a bullet, as they say in the music business. I immediately recognized her talent for expressing sophisticated top-down macroeconomic analyses with easy-to-comprehend and thought-provoking narratives. Although QVI is a bottom-up microeconomic stock-picking service, subscribers should weigh the potential impact of socioeconomic, geopolitical, and technological forces on their investment portfolios. Thus, I am confident that readers will agree that The Pragmatic Optimist does just that as a complementary voice to Quality Value Investing. Amrita, a global citizen who speaks seven languages, is a co-founder and investor of the ProjectM Fund and was a senior manager at two Silicon Valley startups. She has an undergraduate degree in physics from Bates College and an MBA from the University of Rochester’s Simon Business School. Please join me in welcoming Amrita as a guest writer on QVI.

Summary:

Wall Street has been sounding the “recession” alarm for over a year and a half, yet the most anticipated recession has still not arrived.

While a recession may or may not occur in the US in the near future, the one thing that has held the fundamentals of the US economy together and prevented it from falling into a recession (so far) is the stubbornly resilient labor market.

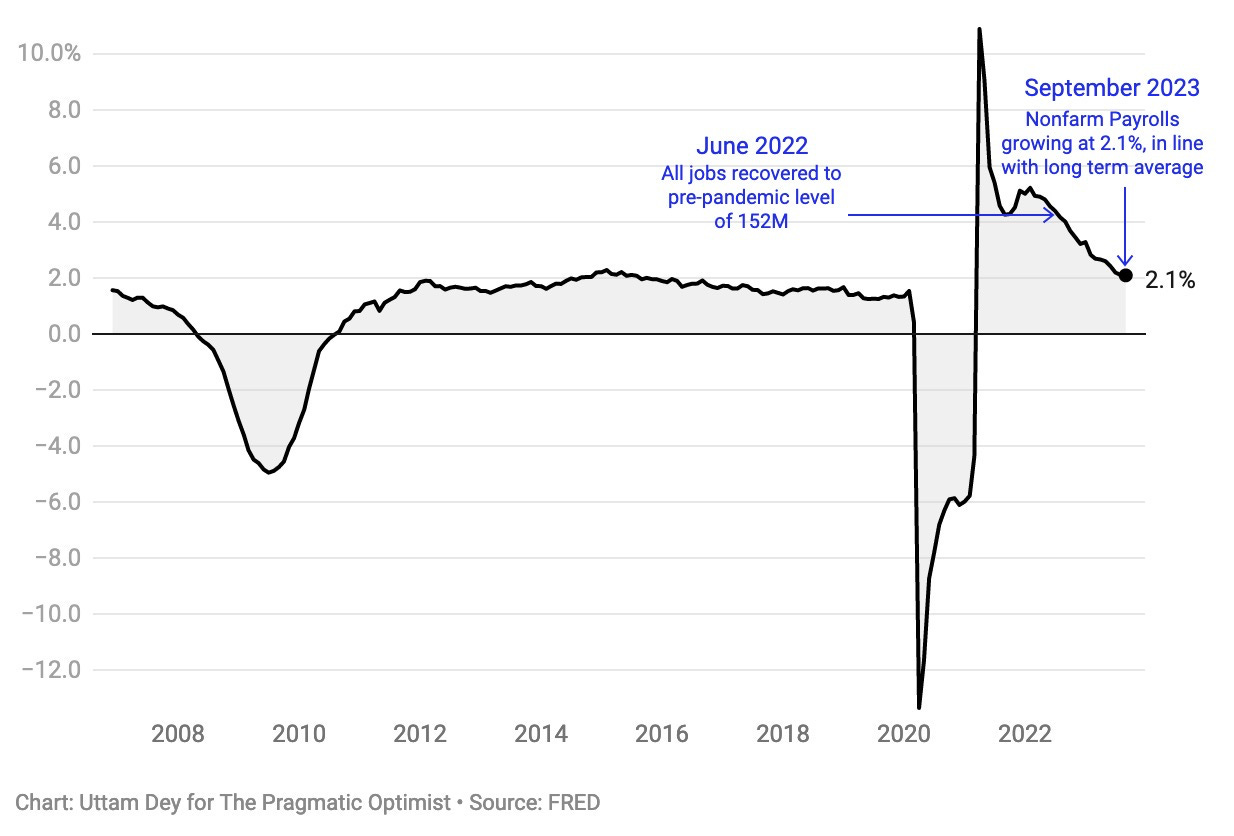

Non-farm payroll is growing at a rate of 2.1% on a year-on-year basis. Non-farm payroll is a good proxy for the real economic growth rate. However, the labor force participation rate has not yet recovered to its pre-pandemic levels due to an aging population and early retirement.

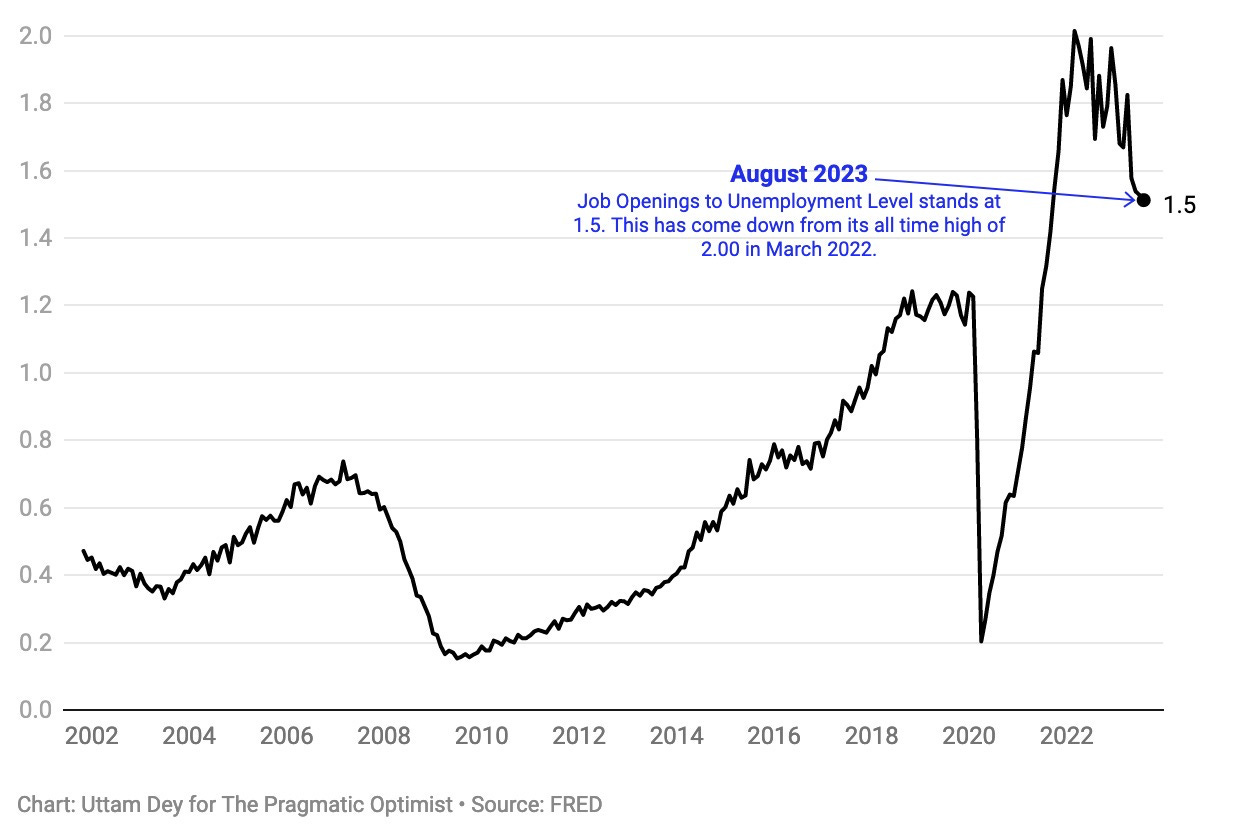

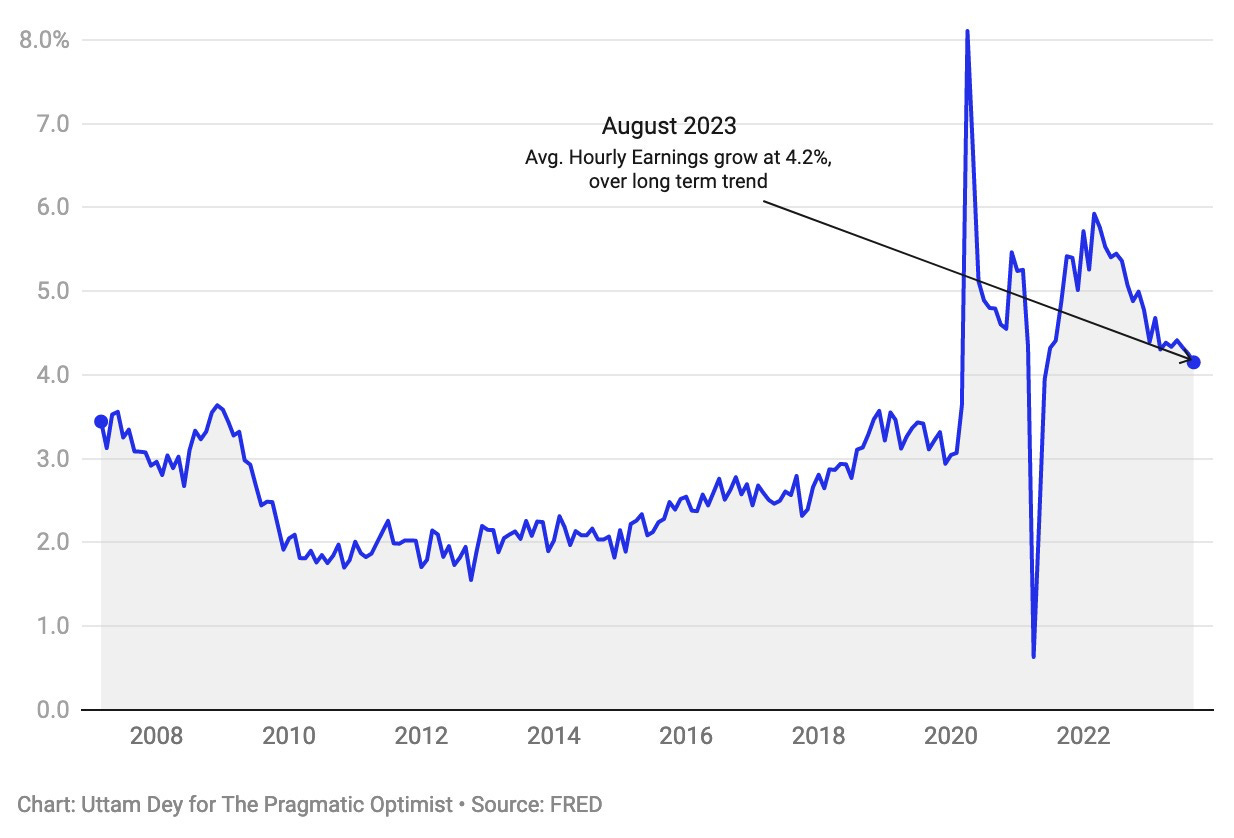

Today, the US economy is near full employment, and there are 1.5 jobs per unemployed person, thus making it a very tight labor market. Nominal wages are growing at 4.2%, as reflected in consumers’ spending behaviors.

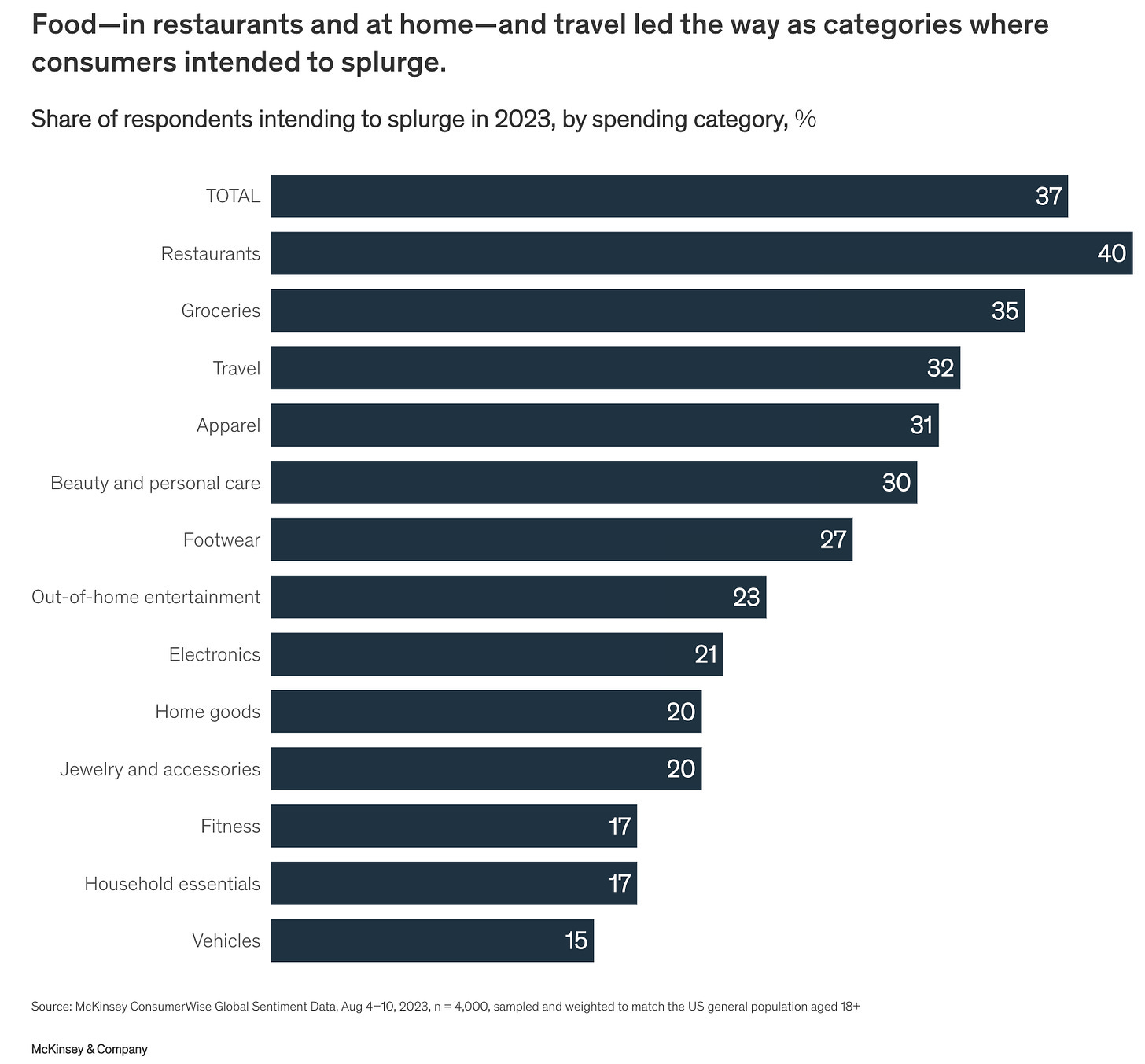

While real consumer spending is growing at 2.4% on a year-on-year basis and the intent to splurge on restaurants and travel remains high across demographics, there are pockets of categories where prices are growing at a much faster rate than wages. One is housing, both rented and owned, which constitutes 33% of all consumer spending.

The US consumer remains cautiously optimistic. As interest rates remain high, consumers’ savings dry up, and consumers lever up, we need to keep an eye out for the state of the US labor market and the growth rate of debt and interest payments relative to disposable personal income.

On March 16, 2022, the US Federal Reserve raised its effective Fed funds rate, also known as interest rate, from 0% to 0.25-0.5% after more than three years. On March 31, 2022, the 2-10Y bond yield curve inverted.

Since then, Wall Street has been pounding the table, with analysts from well-renowned investment banks and research firms warning that a recession is coming. Some analysts predicted that the US economy would tip into a recession by late 2022, while others said that a recession would take place by the first half of 2023.

As time went on, the US economy continued to defy the bold recession prediction, and analysts started pushing out their time horizon for the anticipated recession. As we approach the end of 2023, the most anticipated recession has still not arrived.

While a recession may or may not occur in the US in the near future, there is one thing that has stood out during the last year and a half that held the fundamentals of the US economy together and prevented it from falling into a recession (so far). The US labor market is stubbornly resilient, which makes the US consumer resilient.

Consumer spending plays the most crucial role in driving the US economy, typically representing about 75% of total economic activity in the US. Today, nominal consumer spending is growing at 5.9% on a year-on-year basis, thanks to a resilient labor market. But remember, much of this spending requires financing, particularly for bigger ticket items like homes, automobiles, and higher education. In addition, many consumers take on debt when they use credit cards for day-to-day purchases.

Over the last 12 months, as inflation (Headline PCE) has risen by 3.4% on a year-on-year basis, and consumer savings have depleted, people are increasingly resorting to taking on debt, which stands at an all-time high of $17 trillion.

So, how healthy is the US consumer?

This post is the first of two parts.

In Part 1, we look at the state of the current US labor market and US consumer spending across categories and demographics.

In Part 2, we will take a look at the state of the US consumer debt and consumer savings to assess whether the US consumer is truly healthy or not.

Americans have jobs, and their wages continue to grow

The US labor market fully recovered from all the lost jobs from the pandemic by June 2022 and is now growing at 2.1% on a year-on-year basis, in line with the long-term growth rate.

Remember that the growth rate of non-farm payrolls is usually a valuable proxy to estimate the real growth rate of the economy.

However, had the pandemic never occurred, and the labor market continued to grow between 1.8-2.1% between 2020-2023, the total number of jobs in the US would add up to roughly 162 million as of September 2023. Today, the total number of non-farm payrolls is 156 million. This means the US labor market is still technically trending -3% from where it would have been had a pandemic-induced recession not occurred.

One of the most significant contributing factors to this phenomenon is the drop in the labor force participation rate that we witnessed post-pandemic. Even today, labor force participation stands at 62.8%, much lower than its pre-pandemic levels. This combines an aging population in the US (and in other developed economies) and a larger-than-expected group of people who took early retirement post-pandemic. This, however, is a meaningful headwind for long-term US growth and productivity.

Despite the labor force participation rate being below pandemic levels, the unemployment rate is at 3.8%, usually considered full employment by developed economies’ standards.

The labor market is extremely tight, with 1.5 open jobs for every unemployed person in the economy. This number (while it has come down from its all-time high of 2.0 in March 2022) is still at a historically high level, and it generally means that employers are having difficulty finding the right talent and filling up their open positions. As a result, employers have been naturally inclined to offer more compensation to lure in workers.

This is reflected in the average hourly earnings, where nominal wages are growing at 4.2% on a year-on-year basis. At its peak, nominal wages grew at 5.9% in March 2022. While the growth rate of wages has slowed, it is still growing at a higher rate than in the past decade. This, however, proves to be a headwind for overall inflation to come down to the Fed’s long-term target of 2.2%.

In summary, the US labor market is at or near full employment. Americans have jobs, and their wages continue to grow. This is reflected in their spending behavior, ultimately showing their underlying confidence in the US economy.

US consumer spending is resilient, as wages grow at a higher rate than inflation, but red flags are emerging

As inflation started to cool, real consumer spending increased from the previous year. The real year-over-year spending change rate stands at 2.4% in August 2023.

According to a report by McKinsey, the two most significant real year-over-year spending increases were out-of-home entertainment and cosmetic stores, which showed a growth rate of 12% and 13% YoY, respectively. This was followed closely by the travel segment, which experienced an 11%year-over-year increase in real spending.

At the same time, the gaps in spending growth between high-income and low-income consumers, boomers and Gen Z, and everyone in between narrowed over the summer, as per the same McKinsey report.

Today, food and travel continue to be splurge-worthy categories among US consumers. Over the summer, 40% of GenZ and millennials reported an intent to splurge on restaurants, while 45% of boomers said they intended to splurge on travel. Food for the home represented the most popular splurge-worthy category for low-income respondents at 42% while dining out was the most popular splurge-worthy category amongst high-income respondents at 42%.

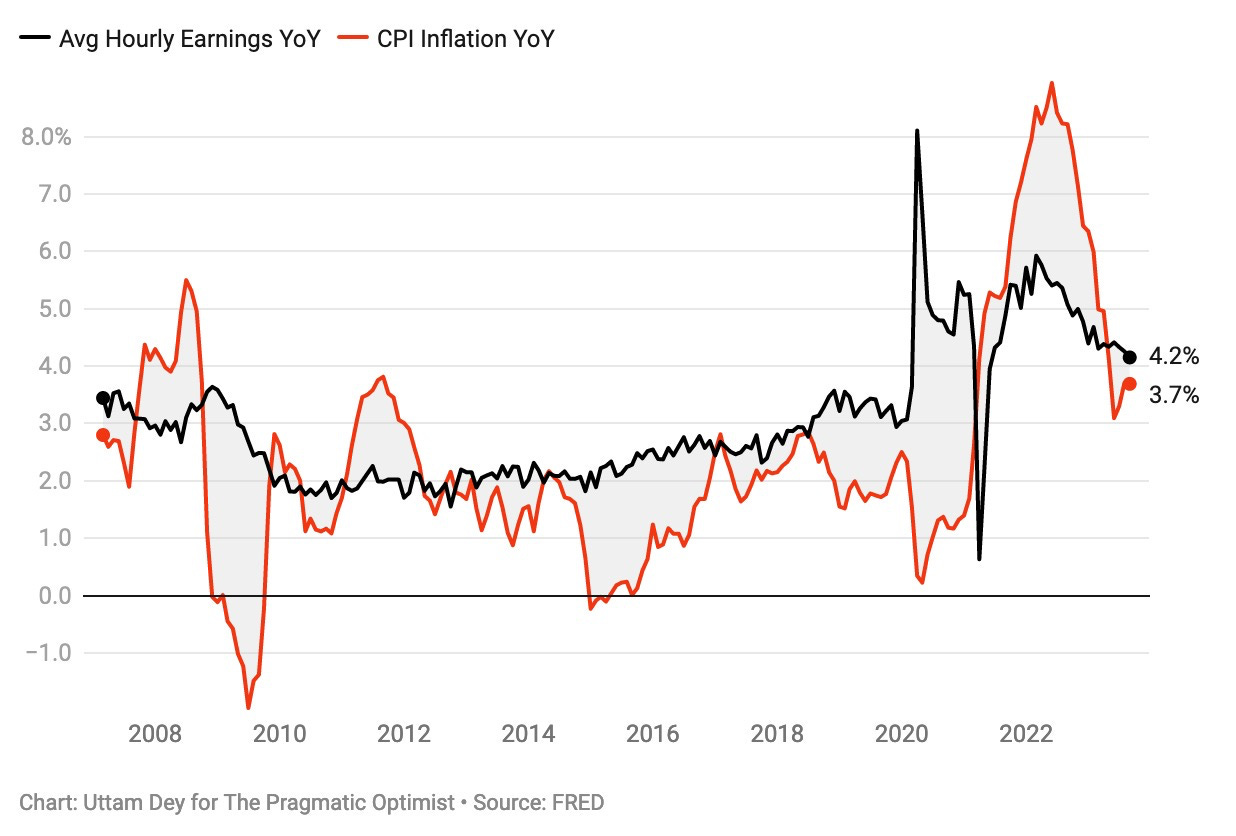

Meanwhile, overall price inflation is growing at a rate of 3.4% on a year-on-year basis, while average hourly earnings are growing at 4.2% on a year-on-year basis. While both indicators are trending above their long-term average, it is a reassuring sign when wages grow slightly faster and over the rate of price changes of goods and services in the economy.

However, if you look one layer deeper, there are categories within the Consumer Price Index basket, such as shelters, that are growing at a significantly faster rate than wages. Housing expenditures, which include rented and owned dwellings, are growing at 7.2% and 7.1%, respectively, much faster than the average wage growth of the US consumer.

Even more critical is that housing expenditures constitute roughly 30-33% of overall consumer spending. So, the US consumer is properly getting squeezed on 33% of their total expenditure allocated to housing, as their wages are not keeping up with shelter inflation.

Ultimately, when both inflation and wages grow at a rate that threatens the long-term inflation target of 2.2%, the Fed continues raising interest rates to quell consumer demand until inflation comes back down. This is what is happening today. As a result, American consumers remain cautiously optimistic.

US consumer optimism in Q3 2023 dropped slightly from the year’s spring highs. Over the summer, 33% of consumers in the US reported feeling optimistic about the economy, while 44% reported mixed feelings. Optimism about the economy grew the most among baby boomers, while millennials reported the most significant decline in optimism.

Closing Thoughts and Next Steps

Today, the US labor market remains resilient, and consumer spending is growing above trend while inflation is cooling. However, high rates and an inverted yield curve are creating storm clouds. As consumers’ savings deplete and they increasingly resort to debt, the market is flashing the red alert on a possible weakening of the US consumer.

In the next section, we will dive into consumer debt and savings data to determine if the US consumer is healthy or about to catch a cold.

Copyright 2023 by Amrita Roy. Republished with permission of the author.

Disclosure: Quality Value Investing by David J. Waldron’s guest writer posts are for informational purposes only. The accuracy of the data cannot be guaranteed. Narrative and analytics are impersonal, i.e., not tailored to individual needs nor intended for portfolio construction, and are presented solely for educational purposes. David and his guest writers are individual investors and authors, not investment advisers. Readers should always engage in their own research or due diligence and consider (as appropriate) consulting a fee-only certified financial planner, licensed discount broker/dealer, flat fee registered investment adviser, certified public accountant, or specialized attorney before making any investment, income tax, or estate planning decisions.

This is an excellent piece, glad it is publicly available. It takes a look at details that paints a much better picture than anything I have seen in the mass media space. The analysis may be there in other channels, but maybe hidden behind paywalls. The analysis is incredibly useful and enlightening to understand the growth engine and picks up the nuance often overlooked by everyone; participation rate and the specific spending categories. This give me a much better understanding of areas that may cause issues later and better shape my spending and investing strategies. Thank you!