The Coca-Cola Company (NYSE: KO)

Quality Value Investing Research Report | $KO Updated Coverage | January 2025

In this updated coverage research report, we reexamine The Coca-Cola Company — KO 0.00%↑ — a consumer staples sector company, to see if it continues to meet Quality Value Investing’s (QVI) Real-Time Stock Picks criteria based on our proprietary checklist analysis of the business’s current wealth and the share price’s present value.

Coca-Cola | Current Wealth

Value Proposition

Coca-Cola is a dividend-paying large-cap stock in the consumer staples sector’s beverages industry. It was added to the QVI Real-Time Stock Picks on October 4, 2010, at a cost basis of $18.98 per share, adjusted for dividends paid in cash.

The Coca-Cola Company, a soft drinks producer, manufactures, markets, and sells various nonalcoholic beverages worldwide. It operates through a network of independent bottling partners, distributors, wholesalers, and retailers, as well as through bottling and distribution operators. The company was founded in 1886 and is headquartered in Atlanta, Georgia, USA.

Economic Moat

Morningstar assigns Coca-Cola a wide-moat rating based on its global beverage operations, substantial intangible assets, and significant cost advantages. Morningstar’s analysts believe these factors should enable the company to deliver excess investment returns above its cost of capital for at least the next twenty years.

QVI’s Value Proposition Elevator Pitch for KO

Coca-Cola is a legendary global powerhouse with a ubiquitous brand name that likely isn’t going anywhere except in consumers’ refrigerators, pantries, and cupholders.

QVI’s value proposition rating for Coca-Cola: Bullish.

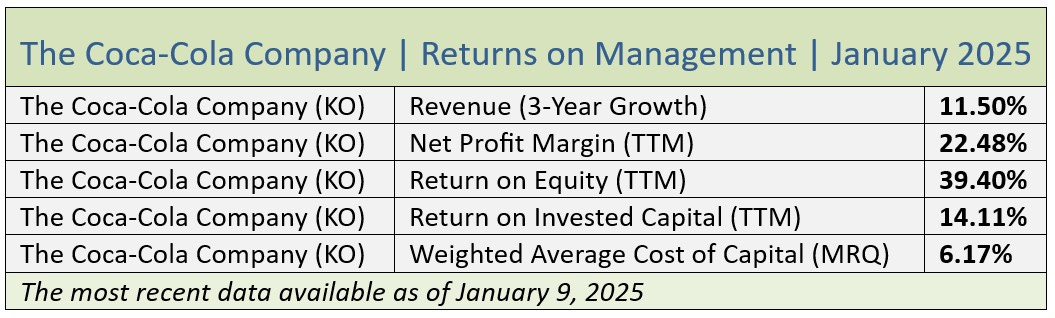

Returns on Management

Revenue Growth and Net Profit Margin

As the table below shows, Coca-Cola’s trailing three-year annualized revenue growth was in the low double digits, but it lagged behind the S&P 500’s topline growth of +16.90%. Moreover, the company’s single-digit revenue growth of +2.97% underperformed the broader market’s +19.60% increase for the most recently reported twelve months.

Further down the income statement, Coca-Cola had a high double-digit net profit margin from a 60.43% gross margin. Moreover, it aligned with the S&P 500’s net profit margin of 21.00% from a gross margin of 54.20%.

Returns on Equity and Invested Capital

Coca-Cola’s senior management produced a return on equity, or ROE, double QVI’s targeted threshold, albeit trailing the S&P 500’s elevated ROE of 55.90%.

Stock buyback programs can elevate ROE. For example, Coca-Cola’s board of directors approved the repurchase of $354 million of its shares for the period ending September 2024.

Coca-Cola’s return on invested capital, or ROIC, aligned with QVI’s threshold while lagging behind the broader market’s 23.70% return. In addition, the company’s ROIC exceeds its weighted average cost of capital, or WACC, demonstrating that its senior executives are competitive capital allocators (Source of WACC: GuruFocus).

QVI’s business fundamentals rating for The Coca-Cola Company: Bullish.

Next, we’ll examine the company’s enterprise downside risks, the stock price’s present value, including share price downside risks, and the investment thesis, all exclusive to Quality Value Investing’s premium (paying) subscribers.

Cyber deals on my fourth book, Build Wealth with Common Stocks, have extended through early 2025. Invest in a copy today!

“Investing advice is fairly commonplace, but here the author shares his own unique investment wisdom that readers will not find elsewhere.” —Critic's Report, The BookLife Prize (Publishers Weekly)

Learn more at https://davidjwaldron.substack.com/p/bookstore

Unless noted, all data presented is sourced from Charles Schwab & Co., Yahoo Finance, and The Coca-Cola Company as of the market close on January 9, 2025, and is intended for illustrative purposes only.

Disclosure: As of the writing of this research report, I/we hold a long, beneficial position in KO common shares in our family portfolio. I wrote this report myself, and it expresses my own opinions. I am not receiving compensation for it other than from Substack paid subscriptions. I have no business relationship with any company whose stock is mentioned in this post.

Additional Disclosure: Quality Value Investing by David J. Waldron’s primary ticker research reports are for informational purposes only. The accuracy of the data cannot be guaranteed. Narrative and analytics are impersonal, meaning they are not tailored to individual needs nor intended for portfolio construction beyond his family portfolio, which is presented solely for educational purposes. David is an individual investor and author, not an investment adviser. Readers should always engage in independent research or due diligence and consider consulting a fee-only certified financial planner, a licensed discount broker/dealer, a flat-fee registered investment adviser, a certified public accountant, or a specialized attorney before making any investment, income tax, or estate planning decisions.

Keep reading with a 7-day free trial

Subscribe to Quality Value Investing to keep reading this post and get 7 days of free access to the full post archives.