NIKE (NYSE: NKE)

Quality Value Investing Research Report | $NKE Updated Coverage | November 2024

In this updated coverage research report, we reexamine the consumer discretionary sector company NIKE Inc. — NKE 0.00%↑ — to see if it continues to meet Quality Value Investing’s (QVI) Real-Time Stock Picks criteria based on our proprietary checklist analysis of the business’s current wealth and the share price’s present value.

NIKE | Company Current Wealth

Value Proposition

NIKE is a dividend-paying large-cap stock in the consumer discretionary sector’s apparel and footwear industry. It was added to the QVI Real-Time Stock Picks on June 6, 2017, at a $48.40 cost basis per share, adjusted for dividends.

NIKE, Inc., together with its subsidiaries, engages in the design, development, marketing, and sale of athletic footwear, apparel, equipment, accessories, and services worldwide. The company was founded in 1964 and is headquartered in Beaverton, Oregon, USA.

Economic Moat

Morningstar assigns NIKE a wide moat rating based on its brand intangible asset.

QVI’s Value Proposition Elevator Pitch for NKE

NIKE’s Swoosh is the moat, as wide as the famous logo.

QVI’s value proposition rating for NKE: Bullish.

Returns on Management

Revenue Growth and Net Profit Margin

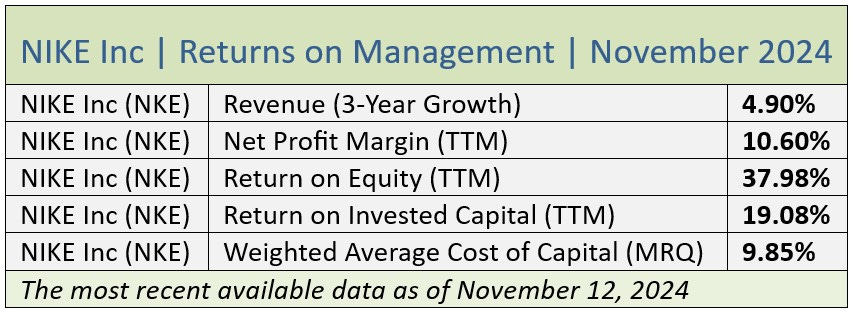

Per the table below, NIKE’s trailing three-year annualized revenue growth was single-digit positive, underperforming the S&P 500 topline growth of 16.70%. Moreover, the company’s negative revenue growth of -2.83% lagged the broader market’s +18.90% for the most recently reported twelve months.

Further down the income statement, NIKE had a low double-digit net profit margin from a 44.84% gross margin, lagging the S&P 500’s net of 20.40% from a gross of 53.90%.

Returns on Equity and Invested Capital

NIKE’s senior management produced a return on equity, or ROE, double QVI’s targeted threshold while underperforming the S&P 500’s ROE of 57.00%.

Stock buyback programs often elevate ROE. For example, NIKE’s board of directors had authorized $18 billion of share repurchases between 2022 and 2026, with $8 billion of that approval still available as of October 2024.

NIKE’s return on invested capital, or ROIC, exceeded QVI’s threshold and aligned with the broader market’s 23.00% return. In addition, the company’s ROIC exceeded its weighted average cost of capital, or WACC, demonstrating that its senior executives are excellent capital allocators (Source of WACC: GuruFocus).

QVI’s business fundamentals rating for NIKE: Bullish.

Next, we’ll look at the company’s enterprise downsize risks, the stock price’s present value, including share price downside risks, and the investment thesis, each exclusive to Quality Value Investing’s premium (paying) subscribers.

Unless noted, all data presented is sourced from Charles Schwab & Co. as of the market close on November 12, 2024, and intended for illustration only.

Disclosure: As of the date of this research report, I/we held no beneficial positions in NKE common shares in our family portfolio. I wrote this report myself, and it expresses my own opinions. I am not receiving compensation for it other than from Substack paid subscriptions. I have no business relationship with any company whose stock is mentioned in this post.

Additional Disclosure: Quality Value Investing by David J. Waldron’s primary ticker research reports are for informational purposes only. The accuracy of the data cannot be guaranteed. Narrative and analytics are impersonal, i.e., not tailored to individual needs nor intended for portfolio construction beyond his family portfolio, which is presented solely for educational purposes. David is an individual investor and author, not an investment adviser. Readers should always engage in independent research or due diligence and consider, as appropriate, consulting a fee-only certified financial planner, licensed discount broker/dealer, flat fee registered investment adviser, certified public accountant, or specialized attorney before making any investment, income tax, or estate planning decisions.

Keep reading with a 7-day free trial

Subscribe to Quality Value Investing to keep reading this post and get 7 days of free access to the full post archives.