McKesson (NYSE: MCK)

Quality Value Investing Research Report | $MCK Updated Coverage | December 2024

In this updated coverage research report, we reexamine McKesson Corporation — MCK 0.00%↑ — a health care sector company, to see if it continues to meet Quality Value Investing’s (QVI) Real-Time Stock Picks criteria based on our proprietary checklist analysis of the business’s current wealth and the share price’s present value.

McKesson | Current Wealth

Value Proposition

McKesson. is a dividend-paying large-cap stock in the health care sector’s distributors industry. It was added to the QVI Real-Time Stock Picks on March 6, 2018, at a cost basis of $142.87 per share, adjusted for dividends paid in cash.

McKesson Corporation provides healthcare services in the United States and internationally. It operates through four segments: U.S. Pharmaceutical, Prescription Technology Solutions (RxTS), Medical-Surgical Solutions, and International. McKesson Corporation was founded in 1833 and is headquartered in Irving, Texas, USA.

Economic Moat

Morningstar assigns McKesson a narrow moat rating based on the U.S. drug distribution market. McKesson’s customers’ unlikeliness to move to a different distributor — switching costs — should uphold its competitive position in the space and continue to support economic profits.

QVI’s Value Proposition Elevator Pitch for MCK

McKesson is the best breed in the U.S. drug distribution oligopoly, equating to a long-term competitive position in the healthcare-dominated 21st century.

QVI’s value proposition rating for McKesson: Bullish.

Returns on Management

Revenue Growth and Net Profit Margin

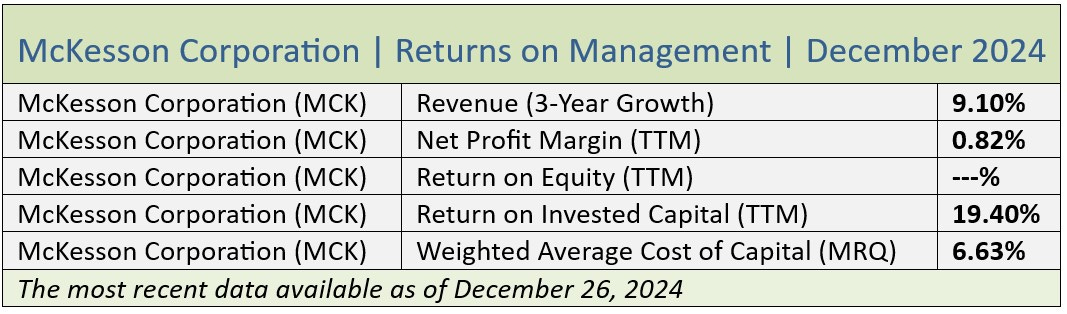

As the table below shows, McKesson’s trailing three-year annualized revenue growth was high-single-digit positive but lagged behind the S&P 500’s topline growth of +16.90%. In contrast, the company’s positive revenue growth of +13.40% better aligned with the broader market’s +19.50% increase for the most recently reported twelve months.

Further down the income statement, McKesson had a positive low-single-digit net profit margin from a 3.92% gross margin, typical of the distributor space. However, it underperformed compared to the S&P 500’s net profit of 21.00% from a gross margin of 54.10%.

Returns on Equity and Invested Capital

McKesson’s senior management produced a negative return on equity, or ROE, below QVI’s targeted threshold and trailing the S&P 500’s ROE of 56.30%. McKesson attributes its declining ROE to the effects of its legal settlements related to the opioid crisis.

Stock buyback programs can elevate ROE, and McKesson has a history of share repurchases. In July 2024, the company announced an increase in its equity buyback plan, authorizing an additional $6 billion.

McKesson’s return on invested capital, or ROIC, exceeded QVI’s threshold and aligned with the broader market’s 23.70% return. In addition, the company’s ROIC exceeded its weighted average cost of capital, or WACC, demonstrating that its senior executives are excellent capital allocators (Source of WACC: GuruFocus).

QVI’s business fundamentals rating for McKesson: Neutral.

Next, we’ll examine the company’s enterprise downside risks, the stock price’s present value, including share price downside risks, and the investment thesis, all exclusive to Quality Value Investing’s premium (paying) subscribers.

Cyber deals on my fourth book, Build Wealth with Common Stocks, are available now through December 31, 2024.

“Investing advice is fairly commonplace, but here the author shares his own unique investment wisdom that readers will not find elsewhere.” —Critic's Report, The BookLife Prize (Publishers Weekly)

Learn more at https://davidjwaldron.substack.com/p/bookstore