Hubbell Incorporated (NYSE: HUBB)

Quality Value Investing Research Report | $HUBB Updated Coverage | November 2024

In this updated coverage research report, we reexamine the industrials sector company Hubbell Incorporated — HUBB 0.00%↑ — to see if it continues to meet Quality Value Investing’s (QVI) Real-Time Stock Picks criteria based on our proprietary checklist analysis of the business’s current wealth and the share price’s present value.

Hubbell | Company Current Wealth

Value Proposition

Hubbell is a dividend-paying mid-cap stock in the industrials sector’s electrical equipment industry. It was added to the QVI Real-Time Stock Picks on November 7, 2023, at a $274.84 cost basis per share, adjusted for dividends.

Hubbell Incorporated, together with its subsidiaries, designs, manufactures, and sells electrical and utility solutions in the United States and internationally. It operates through two segments, Electrical Solutions and Utility Solutions.

Its brand portfolio includes Hubbell, Kellems, Bryant, Burndy, CMC, Bell, TayMac, Wiegmann, Killark, Hawke, Aclara, Fargo, Quazite, and Hot Box. The company was founded in 1888 and is headquartered in Shelton, Connecticut, USA.

Economic Moat

Morningstar no longer covers Hubbell Incorporated but previously assigned the company a narrow moat rating based on its switching costs related to its highly engineered products that provide its customers a lower cost of ownership and its intangible assets related to branding and customer relationships.

QVI’s Value Proposition Elevator Pitch for HUBB

Hubbell is a high-quality industrial conglomerate that consistently returns cash to shareholders as its stock price outperforms the benchmark. The US grid is aging and needs modernization, and Hubbell is a leading infrastructure player.

QVI’s value proposition rating for HUBB: Bullish.

Returns on Management

Revenue Growth and Net Profit Margin

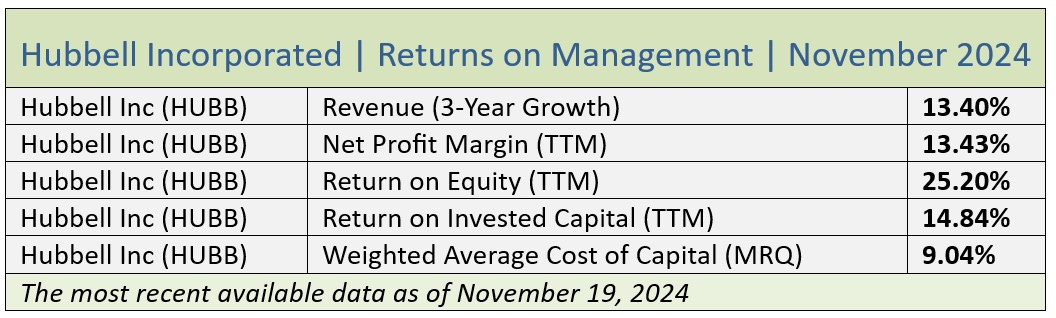

Per the table below, Hubbell’s trailing three-year annualized revenue growth was double-digit positive and aligned with the S&P 500 topline growth of 16.60%. Despite the company’s positive revenue growth of +7.50%, it lagged the broader market’s +18.60% for the most recently reported twelve months.

Further down the income statement, Hubbell had a mid-double-digit net profit margin from a 34.02% gross margin, albeit underperforming the S&P 500’s net of 20.80% from a gross of 54.10%.

Returns on Equity and Invested Capital

Hubbell’s senior management produced a return on equity, or ROE, above QVI’s targeted threshold while underperforming the S&P 500’s ROE of 56.30%.

Although stock buyback programs often elevate ROE, Hubbell’s board of directors authorized a modest $30 million of share repurchases thus far in 2024.

Hubbell’s return on invested capital, or ROIC, exceeded QVI’s threshold but trailed the broader market’s 23.0% return. In addition, the company’s ROIC exceeded its weighted average cost of capital, or WACC, demonstrating that its senior executives are competent capital allocators (Source of WACC: GuruFocus).

QVI’s business fundamentals rating for Hubbell: Bullish.

Next, we’ll look at the company’s enterprise downsize risks, the stock price’s present value, including share price downside risks, and the investment thesis, each exclusive to Quality Value Investing’s premium (paying) subscribers.

Cyber Week Deals on my fourth book, Build Wealth with Common Stocks, are available now through December 2, 2024.

“Investing advice is fairly commonplace, but here the author shares his own unique investment wisdom that readers will not find elsewhere.” —Critic's Report, The BookLife Prize (Publishers Weekly)

Learn more at https://davidjwaldron.substack.com/p/bookstore