Apple (NASDAQ: AAPL)

Quality Value Investing Research Report | $AAPL Updated Coverage | November 2024

In this updated coverage research report, we reexamine the information technology sector company Apple Inc. — AAPL 0.00%↑ — to see if it continues to meet Quality Value Investing’s (QVI) Real-Time Stock Picks criteria based on our checklist analysis of the business’s current wealth and the share price’s present value.

This research report was prepared and scheduled for publishing before the November 5th US presidential election results.

Apple | Company Current Wealth

Value Proposition

Apple is a dividend-paying large-cap stock in the information technology sector’s hardware, storage, and peripherals industry. It was added to the QVI Real-Time Stock Picks on March 8, 2017, at a $32.36 cost basis per share, adjusted for splits and dividends.

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

The company serves consumers, and small and mid-sized businesses, and the education, enterprise, and government markets. It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force, and third-party cellular network carriers, wholesalers, retailers, and resellers.

Apple Inc. was founded in 1976 and is headquartered in Cupertino, California, USA.

Economic Moat

Morningstar assigns Apple a wide moat rating based on customer switching costs, intangible assets, and network effects.

QVI’s Value Proposition Elevator Pitch for AAPL

Apple is the preeminent leader in productivity hardware and services, whether business or personal, mobile, wearables, television, or laptop/desktop, each anchored by its unparalleled iOS ecosystem.

QVI’s value proposition rating for Apple: Bullish.

Returns on Management

Revenue Growth and Net Profit Margin

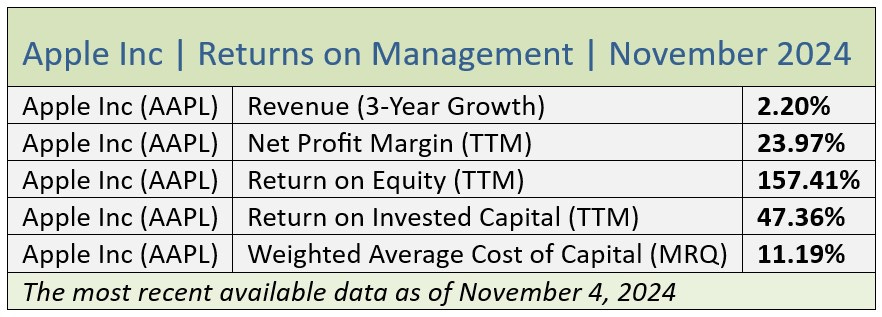

Per the table below, Apple’s trailing three-year annualized revenue growth was single-digit positive, underperforming the S&P 500 topline growth of 16.40%. Moreover, the company’s positive revenue growth of 2.02% lagged the broader market’s +18.20% for the most recently reported twelve months.

Further down the income statement, Apple had a high double-digit net profit margin from a 46.21% gross margin, aligning with the S&P 500’s net of 21.50% from a gross of 54.10%.

Returns on Equity and Invested Capital

Apple’s senior management produced a return on equity, or ROE, well above QVI’s targeted threshold and triple the S&P 500’s ROE of 54.70%.

Stock buyback programs often elevate ROE. For example, in May of this year, Apple’s board of directors approved repurchasing a whopping $110 billion of its common shares, the single largest buyback announcement by a company on record.

Apple’s return on invested capital, or ROIC, quadrupled QVI’s threshold and doubled the broader market’s 23.40% return. In addition, the company’s ROIC exceeded its weighted average cost of capital, or WACC, demonstrating that its senior executives are exceptional capital allocators (Source of WACC: GuruFocus).

QVI’s business fundamentals rating for Apple: Bullish.

Next, we’ll look at the company’s enterprise downsize risks, the stock price’s present value, including share price downside risks, and the investment thesis, each exclusive to Quality Value Investing’s premium (paying) subscribers.