2 Investment Brokerages from QVI's High-Quality Universe | Unlocked

Quality Value Investing's current wealth and present value checklist comparative analysis of brokers $IBKR and $RJF | Premium post unlocked for all readers

This Quality Value Investing (QVI) post examines two investment brokerages from QVI’s high-quality universe: Interactive Brokers Group IBKR 0.00%↑ and Raymond James Financial RJF 0.00%↑.

Although in the same financial services industry group, investment banking and brokerage, IBKR is an online broker, whereas RJF is an on-ground wealth manager.

We aim to uncover whether these two investment brokerage firms meet or exceed the QVI Real-Time Stock Picks criteria based on our proprietary checklist analysis of each business’s current wealth and share price present value.

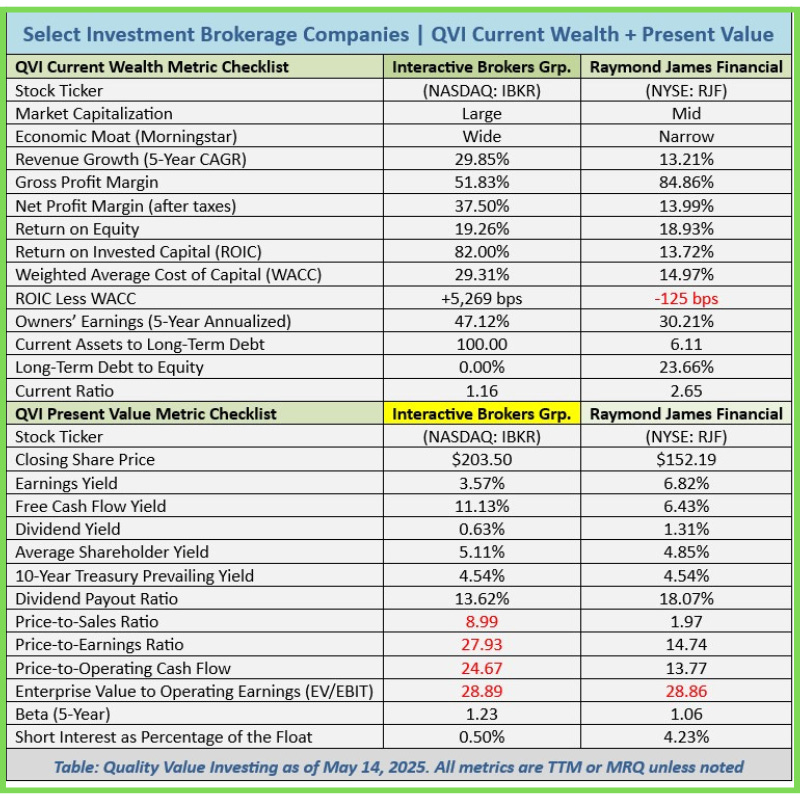

The table below illustrates specific metrics that support the subsequent narrative regarding the selected financial enterprises that survived QVI’s rigorous screening for superior businesses regardless of stock price valuations.

QVI's exclusive high-quality universe watchlist and industry comp research are available to premium subscribers. Consider upgrading your subscription to access quality-driven, value-focused, alpha-achieving analyses.

Check out my new author website, By David J. Waldron, on Substack. Follow the real-time final manuscript writing of my upcoming book, Quality Value Investing: How to Pick Winning Stocks of Enduring Enterprises. Read or listen to updates as I revise my published self-help books chapter by chapter, with audio in each post!

IBKR and RJF Industry Comp Research Checklist

Company Current Wealth

Value Propositions

Interactive Brokers Group, Inc. (NASDAQ: IBKR) operates as an automated electronic broker in the US and internationally. The company executes, clears, and settles trades in stocks, options, futures, foreign exchange, bonds, mutual funds, ETFs, precious metals, and cryptocurrencies. It offers custody and service accounts for hedge funds, mutual funds, ETFs, registered investment advisors, proprietary trading groups, and individual investors. Additionally, it provides custody, prime brokerage, securities, and margin lending services to institutional and individual customers via electronic exchanges and market centers. Founded in 1977, Interactive Brokers Group is headquartered in Greenwich, Connecticut, USA.

Morningstar assigns Interactive Brokers Group a wide economic moat rating due to its competitive position, cost advantage, and intangible assets. The financial services industry is highly competitive, characterized by rapid innovation and consolidation among a few top players offering quality service at lower prices. Morningstar believes Interactive Brokers can succeed long-term by leveraging its automated platform and superior trade execution. The company merits a wide moat, driven by its high level of automation, which enables lower operational costs and intangible assets like BestX tools for order execution. Morningstar’s view is supported by average historical ROICs of 24% over the past decade, significantly above its 9% cost of capital estimate.

Raymond James Financial, Inc. (NYSE: RJF) is a diversified financial services company that offers private client group services, capital markets, asset management, banking, and more to individuals, corporations, and municipalities in the U.S., Canada, and Europe. The company operates in five segments: Private Client Group, Capital Markets, Asset Management, Banking, and Other, which focuses on private equity investments in third-party funds. Founded in 1962, Raymond James Financial is headquartered in Saint Petersburg, Florida, USA.

Morningstar assigns Raymond James Financial a narrow economic moat due to switching costs in wealth management, contributing over 70% of revenue and 60% of pretax earnings. Wealth management alone generates over 75% of revenue and typically exceeds 75% of pretax earnings, boosted by a strong 13% CAGR in client assets and 4% in advisor headcount since 2010. Growth is supported by major acquisitions like Morgan Keegan, Alex Brown, 3Macs, and Charles Stanley. Of the 8,787 affiliated advisors at the end of fiscal 2024, about 45% are employee advisors and 55% independent contractors. As the industry leans towards independent contractors, the company’s affiliation options encourage healthy diversification.

Returns on Management

Interactive Brokers Group and Raymond James Financial have each experienced positive double-digit revenue growth, with Interactive Brokers doubling Raymond James.

Each management team delivers positive double-digit net profit margins (after taxes), with Interactive Brokers tripling Raymond James.

The two companies generate returns on equity and invested capital that exceed QVI’s thresholds. Interactive Brokers stands out as the leader in ROE and ROIC, including the coverage of its weighted average capital costs (WACC). Notably, Raymond James has not been covering its WACC lately.

Each player offers its shareholders exceptional owner earnings — annualized EPS and dividend rate growth, with Interactive Brokers again leading the way.

Enterprise Downside Risks

Due to its zero long-term debt, Interactive Brokers has an unleveraged balance sheet. Moreover, Raymond James shows excellent leverage in its balance sheet liquidity, including solid coverage of its long-term debt with current assets and shareholder liquidity.

Led by Raymond James, each company has covered its short-term debt, or current ratio, and can pay 100% of current liabilities with current assets.

Stock Price Present Value

Shareholder Yields

The selected investment brokerage stocks’ average share price yields on earnings, free cash flow, and dividends exceeded the prevailing rate on the US 10-year Treasury. This dual outcome suggests that the presumed lower-risk intermediate government bonds lag these higher-risk stocks.

Both Interactive Brokers and Raymond James pay a dividend, each with conservative payout ratios, allowing room for additional rate increases on their modest dividend yields.

Valuation Multiples

When analyzing QVI’s preferred valuation multiples, including prices to sales, earnings, operating cash flow, and enterprise value to operating earnings, only RJF appears reasonably priced. IBKR weighs a super-premium valuation.

In contrast to IBKR, RJF’s valuations are more reasonable when comparing sales and earnings ratios. IBKR’s price-to-operating cash flow ratio is more than double QVI’s ceiling, while RJF’s is just above the threshold.

Almost identical EV to EBIT valuations suggest that the broader market has overbought or undersold each stock.

Share Price Downside Risks

IBKR and RJF’s betas are aligned with QVI’s ceiling and the S&P 500 standard, indicating average market volatility for each stock.

Short interest as a percentage of the float suggests that nearsighted traders have limited concerns about IBKR, but likely issues with RJF.

Catalysts

Although anchored in unreliable predictive analysis and excessive business modeling, selected catalysts for the two financial services companies include, but are not limited to:

What the Bulls Say—

Prolonged equity market volatility and elevated interest rates could benefit Interactive Brokers' profitable hedge fund clients. ForecastEx offers option value, especially if prediction markets outperform expert forecasts or act as effective hedging tools. Continued growth in retail trading may favor firms like Interactive Brokers that provide essential tools: affordable margin lending, investor education, and competitive cash yields.

Additional acquisitions can enhance Raymond James’s earnings if the macro environment falters. The brokerage may have a better chance to recruit advisors as it fills gaps in its geographic footprint and offers both employee and independent advisor affiliation options. The company's large wealth management business provides stability to its revenue and earnings.

What the Bears Say—

The shift of passive institutional order flow to dark pools and ATSs may widen bid-ask spreads and create liquidity challenges for brokers. Without a full-service platform, the firm risks losing assets if competitors like Schwab and Fidelity improve their margin rates, trading capabilities, and global investment tools. Geopolitical fragmentation and declining interest in US risk assets will disproportionately affect Interactive Brokers, as half of its client equity is outside the US.

Over the next several years, lower interest rates will stifle net income growth. The wealth management industry is changing relatively rapidly because of technology and regulations. The potentially harmful disruption and competition may outweigh any benefits. While Raymond James shows a significant amount of cash on its balance sheet, a large amount is restricted and tied up in subsidiaries.

Source of catalysts: Morningstar (edited for clarity).

Industry Comp Analysis of IBKR and RJF

The investment brokerage industry in the USA is a dynamic and substantial segment of the financial services market, characterized by intense competition, technological innovation, and a complex regulatory landscape. As of early 2025, the industry continues to evolve, driven by changing economic conditions, investor preferences, and ongoing technological advancements.

Market Overview:

The US investment brokerage industry is a multi-trillion-dollar market, with major firms like Vanguard, Charles Schwab, and Fidelity managing trillions in assets. In early 2025, Vanguard and Schwab reported around $10 trillion in AUM, while Fidelity also handled substantial AUM. Despite ongoing market volatility, the industry saw strong AUM growth in 2024 from positive market returns and user increases. Notably, Fidelity had the most active brokerage accounts.

The economic outlook for 2025 shows slowing growth, moderate inflation, and a cautious Federal Reserve regarding rate cuts. This viewpoint affects investment strategies and brokerage firm performance. Analysts expect the US Securities Brokerage Market to reach about $205.32 billion in 2025.

(Source of industry overview: Google’s Gemini — edited for clarity).

QVI’s Research and Analysis Recap

In this industry comp, using Quality Value Investing’s current wealth and present value checklist analysis, Interactive Brokers Group and Raymond James Financial rate well in current wealth, confirming their inclusion on QVI’s high-quality watchlist. However, Raymond James falls short in its ROIC coverage of its WACC, necessitating improvements in management’s capital allocation in an industry with higher capital costs than the broader market.

IBKR appears at a premium price, with RJF closer to fair value yet at a premium to QVI’s heavily weighted EV/EBIT ratio.

Based on this industry comp overview, neither Interactive Brokers nor Raymond James merits QVI Real-Time Stock Picks’ initial coverage until a macro or micro event brings IBKR to a temporary reasonable price. All else equal, RJF needs to improve returns on invested capital and show a temporary bargain price from an event as reflected in the market sentiment indicator of EV/EBIT.

Remember to conduct your due diligence and read the necessary disclosures.

Resources

What are your thoughts on IBKR, RJF, or other opportunities in the investment brokerage space?

For their upfront generosity, Founding Premium+ (Lifetime) subscribers supporting QVI on Substack Finance receive a complimentary permanent subscription renewal for the service’s life after the first paid year, with no renewal needed.

If the button is not functional on your mobile device, enter this URL in your desktop or laptop browser and go to the Premium+ Founder column:

davidjwaldron.substack.com/subscribe